The City Council has approved a $99 million, scaled down version of Republican Mayor Erin Stewart’s original plan to borrow $115 million to push city debt into the future.

While tension had risen last week, after reports, called, “misleading,” and, “inaccurate,” that a debt deal had already been concluded, discussions reportedly continued right up to the day of the vote. In the end, in their meeting on March 28, 2018, all fifteen members of the Council voted to approve the scaled-down debt authorization.

While tension had risen last week, after reports, called, “misleading,” and, “inaccurate,” that a debt deal had already been concluded, discussions reportedly continued right up to the day of the vote. In the end, in their meeting on March 28, 2018, all fifteen members of the Council voted to approve the scaled-down debt authorization.

“I think, at the end of the day,” Council Majority Leader Carlo Carlozzi, Jr. (D-5) said, “the city is in a much better situation than we would have been initially.”

John Healey, a Managing Director for the city’s debt underwriter, Mesirow Financial, presented two possible plans for borrowing and debt restructuring to the City Council that he said were in response to concerns that had been raised, principally by Council Democrats. Healey said that the decision of the Council on March 28th would be authorizing the borrowing, but not deciding on a specific plan for restructuring.

Under Stewart’s $115 million plan, city taxpayers would be paying current city debt for an additional ten years, to the year 2047. But, the plans considered by the Council decreased that extension, apparently extending the number of years of repayment by two or three years.

In addition to decreasing the borrowing authorization amount from Stewart’s original $115 million to $99 million, Healey said that the currently estimated amount of borrowing to be done by the city would $90 to $92 million, depending on which of the two restructuring plans will be selected.

According to City Council members, Stewart’s original plan would have added over $69 million to city debt service and increased the city’s total debt obligation from $380 million to $449 million.

The two plans considered by the Council would differ in the amount they would add to the total city obligation. One plan would have a period of lesser amounts of repayment than the other plan, but would, according to Healey cost city taxpayers an additional $70 million in indebtedness. The other plan would involve more aggressive repayment, and cost an additional $64 million.

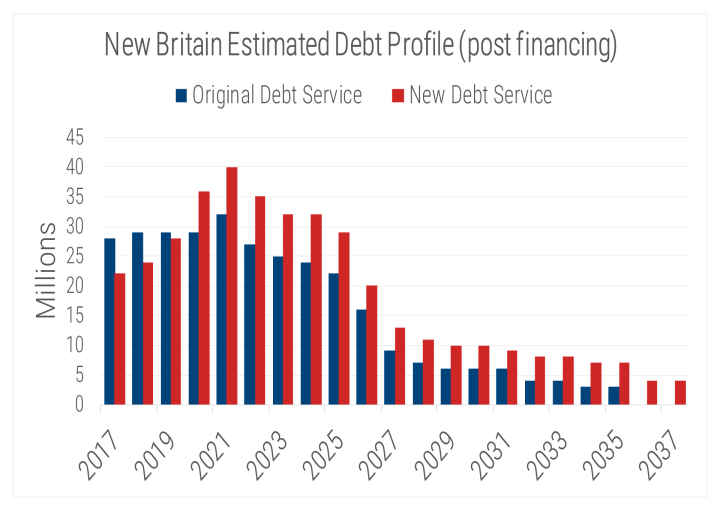

While Stewart’s original $115 million plan would have apparently created a temporary decrease in city debt repayment during the current budget year and the next two budget years, the two plans considered by the Council would appear to keep city debt payments at around the $24 million per year that the city is projected to owe in the current budget year. That $24 million appears to remain stable in the plans the Council considered for the next seven budget years, before gradually decreasing.

Stewart’s original $115 million borrowing plan would have dramatically decreased the amount of debt repayments for both of the next two city budgets that Stewart would be responsible for putting together during her current term of office. The borrowing would have apparently decreased the amount of debt repayment from around $29 million to around $17.5 million in the upcoming 2018-2019 budget year and from around $36 million to around $20 million in the 2019-2020 budget year. For years after that, the payments would go up to about $26 million per year.

When Stewart proposed her original $115 million plan, she had already faced intense criticism for having pushed millions of dollars of debt payments into what are now the upcoming budget years in order to artificially lower costs during the first few years of her administration. Those “restructuring” transactions resulted in higher upcoming debt payments for city taxpayers, such as the projected annual debt service owed by city taxpayers of $36 million in the 2019-2020 budget year and $39 million in the 2020-2021 budget year.

Last year, a graph from the city was obtained that showed that past Stewart “debt restructuring,” has resulted in a reduction in short-term debt payments during earlier years of her administration, while pushing that debt into a spike in taxpayer debt payments hitting the city budget in upcoming years. Stewart’s opponent in the 2017 Mayoral election, Merrill Gay, had highlighted concerns about the effect of Stewart’s refinancing policies on the city’s future.

That appeared to be confirmed by Healey in a presentation before the City Council on December 11, 2017, in which he admitted that, “A lot of what was said over the course of the campaign, as far as, you know, the city’s restructuring and the debt that, the debt spikes that are out there – that was absolutely true.”

Stewart and other Republicans had criticized Council Democrats’ decisions to delay action on her original $115 million plan in January, saying that the delays would result in higher cost to taxpayers because of changes in interest rates going forward. Democrats defended the delay, saying that the people of the city expected them to take the time to gain more information and consider other options.

As the Council discussion on March 28th on the $99 million debt authorization came to a close, Carlozzi pointedly asked Healey, “If we voted on January, the 10th, originally, and this is a simple yes or no, would we have locked in the interest rate of January the 10th?”

Healey answered, “No.”

Before voting the approve the scaled down restructuring plan, Carlozzi said, of the plan, “I think that, at the end of the day we will be a better community and better off in future administrations because of this.”

Editor’s Note (3/31/2018): The article was corrected to note that Mesirow Financial is the city’s debt underwriter.