Fitch “does not consider this to be a prudent management practice during a period of recovery.”

By John McNamara

In a perfunctory special meeting on June 1st the Common Council unanimously adopted a municipal budget for the year that starts July 1st. The $251,046,177 million budget for the new fiscal year is “controlled, calculated and cautious”, according to Mayor Erin Stewart. Stewart glowingly pointed to sustaining a 49.5 mill rate with no cuts to city services nor layoffs and “a declining debt profile” in a 2022-2023 budget presentation.

City Hall Watch

The Mayor’s assertion that the city’s debt profile is “declining”, however, may be misleading. A 2022 debt restructuring plan for new borrowing prepared by Mesirow, the city’s underwriter, and a current analysis by a bond ratings service on this year’s refinancing points to escalating debt service.

John Healey, a Mesirow Managing Director for Public Finance and Erin Stewart’s chief of staff in her first term, handles the City of New Britain account for his employer, a Chicago-based financial services firm. After leaving the New Britain Mayor’s office, Healey was employed at William Blair & Company which also handled debt management with the city’s Finance Department before it went to Mesirow.

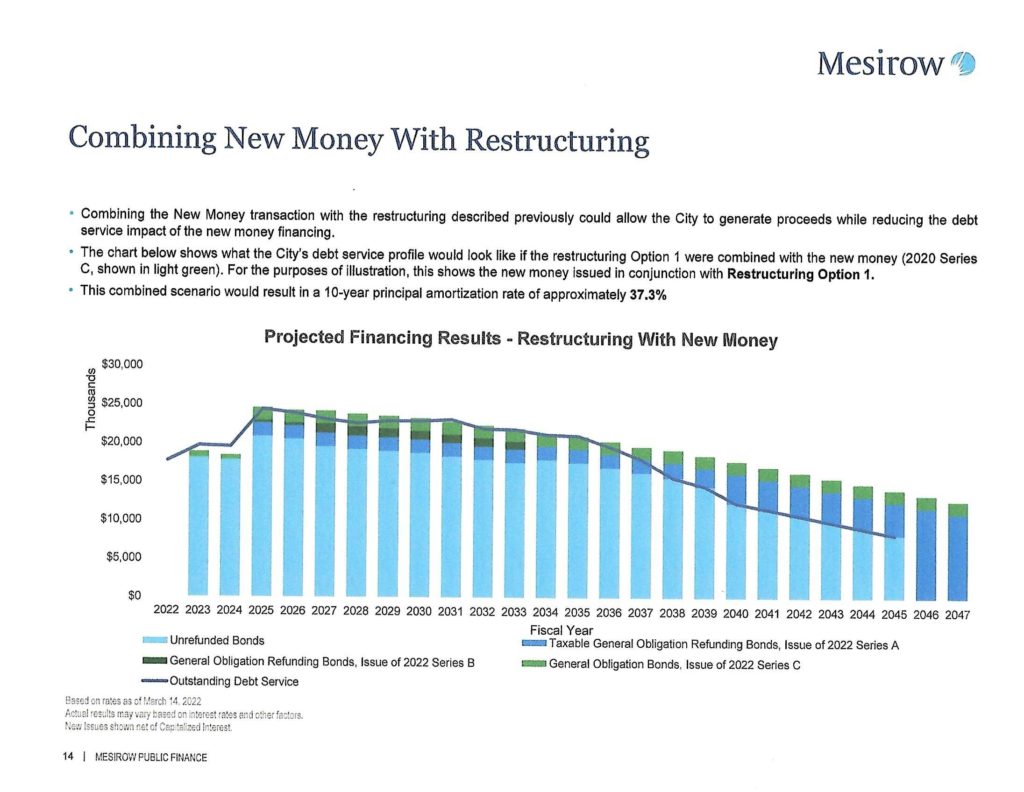

Healey, addressing the Council’s Standing Bond Subcommittee last March, downplayed the latest debt management move as just “a mini restructuring” and part of the city’s multi-year strategy to manage the debt. The $71 million General Obligation Bond Series A,B & C” of 2022 re-financing is not as large as previous ones, said Healey, as it would cover costs for the city garage and other new projects and re-finance some prior debt. Healey obtusely stated that “we wanted to lessen the impact” of current obligations and provide “enough space” that “doesn’t create negative budgetary pressures over the next few years.”

Last month Fitch Ratings, one of the Wall Street rating services that assess municipal finances for investors (others include Standard & Poor’s and Moody’s ) weighed in on New Britain’s latest re-financing, giving the new series of bonds an A-, stable rating. “While this bond restructuring does not provide for near term budget relief, as was achieved with the city’s prior bond restructurings, it does extend the life of existing debt with dis-savings and lowers long-term financial flexibility with slower principal amortization.” The Fitch analysis stated that the continued practice of re-financing in which interest overtake payments on principal is not sustainable.

Fitch “does not consider this to be a prudent management practice during a period of recovery” and “the series 2022 bond restructuring reduces principal amortization to 41% over 10 years, limiting this point of flexibility going forward and increasing the burden of carrying costs in the future.”

Right photo: Mesirow Municipal Finance Director John Healey addresses Common Council Bond Subcommittee last March (City of New Britain).

The Erin Stewart administration has repeatedly turned to re-financing to delay notes coming due on indebtedness. Year in and year out election year tax cuts, budget surpluses and new spending are producing “negative savings” and increasing interest costs over paying down principal.

All of this is why the bond lenders hold cities in a cycle of borrowing for needed capital improvements not favorable to fiscal stability and taxpaying residents. In Fitch’s appraisal of 2022 refinanced bonds, for example, the ratings service happily points out that property revaluation is happening in New Britain this year which will bring higher assessments and new tax revenue, reassuring lenders and investors that the city can keep paying for debt service. Unhappily, homeowners can expect double digit increases to their assessments and bigger tax bills in 2023.

Prior to this year in 2020, the city replaced $20.4 million in debt at an average maturity of five years with $21.3 million and an average maturity of 23.1 years. A taxable series in 2018 replaced $74.9 million at an average maturity of 4.35 years with $91.64 million in borrowing having an average maturity of 15.8 years. And in 2016 a refinanced bond series replaced $47.5 million in debt with an average maturity of 2.3 years with $44.5 million in debt having an average maturity of 5.4 years.

Common Council Minority Leader Aram Ayalon (D-3), following approval of the 2022-23 budget, expressed alarm at the frequency of refinancing. He says the city “is in big trouble. We have a debt of $443 million that is almost twice the city budget and we don’t have a financial advisor to independently assess options. The underwriter is the one who advises the mayor and that is a conflict of interest.” Ayalon says the city should engage an independent financial advisor because the underwriter, by regulation, cannot be the advisor as it gets large fees every time refinancing occurs. “We’ve added $33 million to our debt and will be paying only 37% (Mesirow’s March estimate) of our principal and it’s supposed to be over 50%.” says Ayalon, who fears that within a few years major tax increases or cuts in services or both will be the result of the overuse of refinancing.

The 2022 debt deal continues the pattern of “scoops and tosses” which is investor vernacular for cash strapped city governments “scooping” up prior debts and “tossing” them into the future for another administration to handle. Even if refinancing comes with lower interest rates, kicking the can down the road results in higher debt burdens in the out years. “Cities are prohibited from directly bonding for current operations,” says a former official of the state Office of Management and Budget (OMB), “but this appears to be a back-door move to essentially accomplish the same thing by shifting obligations to the long term.”

The 2022 Bond series consummated in May adds over $33 million in debt service over the life of the restructured bonds. It extends the maturity of the restructured debt by 13 years from 8.97 years to 22.5 years. It extends the maturity of the restructured debt so severely, according to one analysis, that it reduces the percentage of total principal amortized in the next ten years for a $443 million debt, from 45.5% to 37.3%. Despite the Stewart administration’s position that the refinancing lowers the city’s debt profile, it will not solve the problem of escalating debt service in 2025. A sharp increase in debt service in subsequent years will be the result of prior “scoops and tosses” and may set up another move to “kick the can down the road” all over again in 2024.

Concerns have been raised in past years that the “back door move” of re-financing debt every other year will eventually make taxpayers pay a steep price. It should be noted that Mayor Stewart has not carried out a “dis-savings’ strategy alone. Both Democrats and Republicans on past Common Councils with some exceptions have gone along for the ride. And with her super-majority during this term, a rubber-stamp Common Council unfailingly complies with what the administration wants.

“Unfortunately, voters often reward elected officials for decisions that are expedient in the short-term but push costs out into the future.” states a 2009 report on why taxpayers should be concerned with “intergenerational equity” in municipal finance. “When faced with the decision to raise taxes (or cut services) this year or next year, most elected officials choose next year because most voters also prefer next year. Until voters hold elected officials accountable for decisions that push true costs into the future, they will have little incentive to make the right choices for the long-term.”