Mayor’s Mill Rate Increase Will Hike Taxes An Average Of $204 On Single Family Homes

Republicans Falsely Claim A $44 Increase After Double Digit Increases This Year; State Stabilization Funds Add $10 Million To City Revenue For Fiscal Year 2025

By John McNamara

The dust is settling on the making of the 2024-2025 municipal budget for the Stewart Administration and the closely-divided Common Council of eight Democrats and seven Republicans.

The Stewart Administration’s proposed $269,532,733 budget for the fiscal year that begins July 1 comes with a 1.31 mill rate increase to 39.59, raising $147,961,910 in current taxes over this year’s 38.28 mill rate that raised $143,199,174.

The 2024 tax haul ($15,835,516) was 12.58 percent more than 2023 after revaluation sent property assessments soaring. The higher values caused a drop in the mill rate (from 49.50 to 38.28) but resulted in the highest tax bills in memory for single and multi family dwellings. Over two years current taxes are up $20,598,252 (16%).

NB Politicus: Municipal Budget Report

On May 22nd the Common Council failed to either adopt the Mayor’s budget or a Democratic no-tax increase alternative. The Democratic alternative used new state aid approved in the last days of the state legislative session and unfilled vacancies combined with other savings. It included holding off on hiring a controversial, charter-approved chief operative officer (COO) within the Mayor’s office, to keep the mill rate the same. The alternative failed, however, on an 11 to 4 vote over uncertainty over use of state aid and the filling of vacant positions. The Mayor had scheduled a budget meeting for June 5th, but subsequently cancelled it.

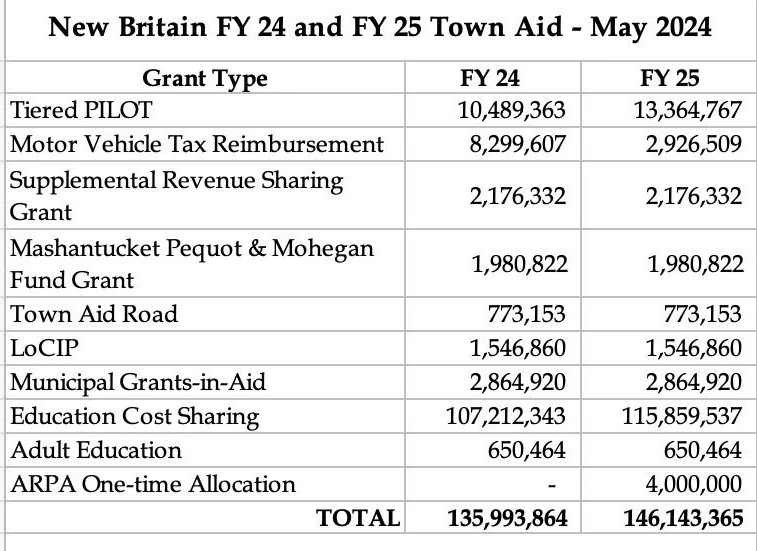

Under the city charter the Council stalemate means that the Mayor’s budget proposed in April will take effect July 1. Unresolved is how to use the new state aid including $4,000,000 in one-time American Rescue Plan (ARPA) money that must be allocated by December 31st. The Democratic alternative proposed use of $2,864,147 in increased state Payments in lieu of Taxes (PILOT) Funds and a portion of state ARPA funds ($1,073,492) combined with at least $533,014 in savings in the municipal budget for no increase in taxes.

It is unlikely that a Democratic tax-relief amendment would have prevailed under any circumstances this year. Republican alderpersons (also known as the RUD caucus) consistently vote as a unit to rubber stamp whatever the administration wants. It takes 10 alders to override a mayoral veto. Republican Council leaders were dismissive of collaborative talks, and were unwilling to discuss any changes to the Mayor’s budget as originally proposed in the run up to the one budget vote that occurred.

The Tax Increase

Public statements by Mayor Stewart and Assistant Council Minority Leader Sharon Beloin-Saavedra falsely claimed that the 1.31 mill rate increase will amount to a $44 hike on the average home in New Britain. According to 2023 Grand List data that the city submits to the state Office of Policy and Management (OPM), however, the average assessment on residences (70% of value for tax purposes) is $155,765. That brings the new “average” tax increase to $204 on single family homes. The increases will be close to $300 or more for the city’s many two- and three-family homes. For a two-family house assessed at $218,960, for example, the increase is $287.00 The tax bill for the same two-family house in 2024 was $1,317.00 higher with an annual bill of $8,382.00 as property owners still feel the effects of the post-revaluation spike in their taxes this year.

Education Funding

Mayor Stewart cited a “$2 million increase” in her budget for the city’s schools. But the Mayor’s own estimates show that local school aid will decrease by $726,407 in 2024-2025. Her budget provides for $500,000 more to the schools’ operating funds to $128,000,000 and $1,500,000 in non-operating funds for $130,068,039. For this fiscal year ending June 30th the schools’ appropriation was higher. It totaled $130,794,446 in operating and non-operating funds. Using a “non-operating” line for education avoids the state’s minimum budget requirement (MBR) that prohibits a town from budgeting less for schools than it did the previous year. School officials must request the non-operating money from the city after the fiscal year begins.

The Board of Education, facing the end of all Elementary and Secondary School Emergency Relief funds (ESSER), eliminated 87 positions in its budget plan for the new fiscal year of the 300 jobs that were created with the temporary federal money during the height of the pandemic.

In order to fund “mission critical” functions in the school district, the BOE requested $133,287,680, a 4.6% increase in local aid. The Mayor’s budget left the BOE with a $3,219,641 shortfall for its “mission-critical” needs. At the 11th hour, the shortfall has been averted with the passage of the state’s stabilization funding plan using unspent state ARPA federal money to aid school districts and provide cities and towns with new funds for tax relief or other purposes.

Mayor Stewart’s flat or reduced funding for schools is consistent with previous budgets of her administration. Year over year the only component of the municipal budget that does not keep pace with inflation is education. At $15,768 per student, New Britain ranks 163rd in the state for investments in education, $4,487 below the state median of $20,615.

City Hall Spending

Unlike the reduced support for education, the 2024-2025 budget for the rest of municipal government ($138,464.694) is largely a maintenance of effort plan that meets contractual obligations and the higher costs of debt service, municipal insurance, and employee benefits.

The budget includes substantial increases to debt service ($25,944,468, +18%) and municipal insurance ($3,617,184, +31.3%). These two obligations alone represent 11 percent of total spending apart from direct services.

Fire and Police departments — the two largest in city government — remain at the same spending levels as 2024 for example. Other services where new resources would be justified such as health and building and housing and homeless also remain the same.

That cannot be said for the Mayor who is a spendthrift in her corner office compared to other departments. Over two years the Mayor’s office budget has increased nearly 39 percent from $458,707 to $637,360. In addition to the $150,000 salary for Chief Operating Officer that has gone unfilled after two searches, a new Director of Constituent Services position has been added. The mayor’s staff already includes two full-time positions dedicated exclusively to public relations and social media. The Mayor’s budget also includes a $20,000 line for “discretionary” spending and controls an “administration and contingency” account of $2,401,864.

The Outlook For 2025

The Mayor and Council will face more challenges next year at budget time and will not have the one-time funding provided by the Legislature’s stabilization plan for town aid and educational cost sharing funding. If past is prelude the city’s legislative delegation can be expected to push for and get increases for both education, PILOT and other forms of town aid when the General Assembly convenes next January to adopt a new biennial state budget.

The situation points to the need for more fiscal discipline at City Hall than is the case now and making property tax relief a priority at the local and state level in 2025.

.

John McNamara is an alderman from Ward 4 and the Common Council Majority Leader. He has been sharing stories and writing about local government and the community on his nbpoliticus.com blog since 2006.

Editor’s note (6/9/2024): At the author’s request, a typo was corrected in the FY2024 mill rate.